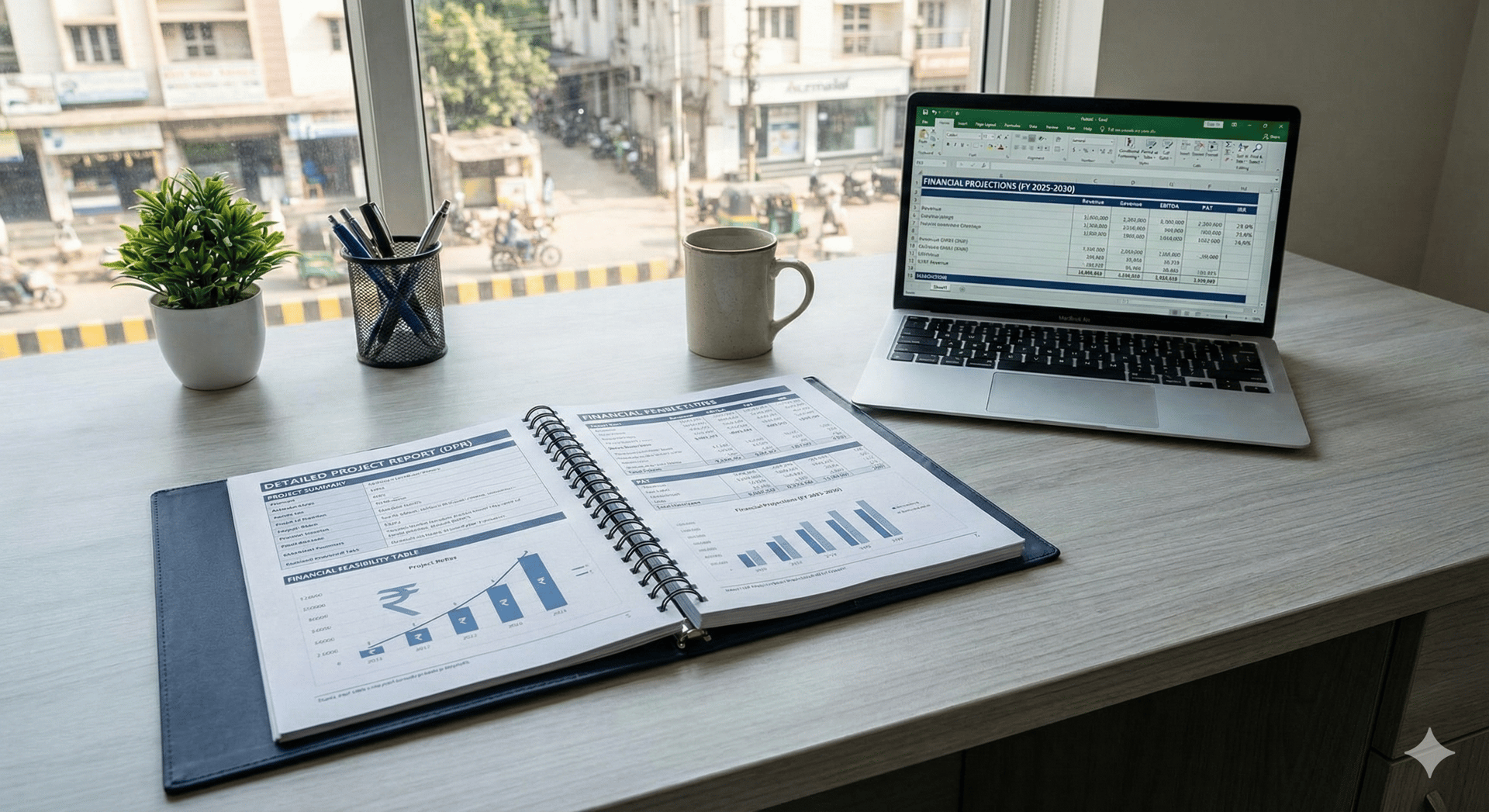

Bank-Ready Project report and CMA Data for Loan Proposals

Professionally prepared Detailed Project Reports aligned with bank appraisal requirements and credit assessment expectations.

Starts at only ₹2,999

Why banks raise repeated queries on Project Reports

Most loan proposals don’t fail because the business idea is weak. They fail because the Project Report and CMA data are poorly structured, generic, or not aligned with what banks actually review. Banks look for clarity on project viability, cost structure, funding pattern, and risk — not long narratives or copied formats.

What we do for you

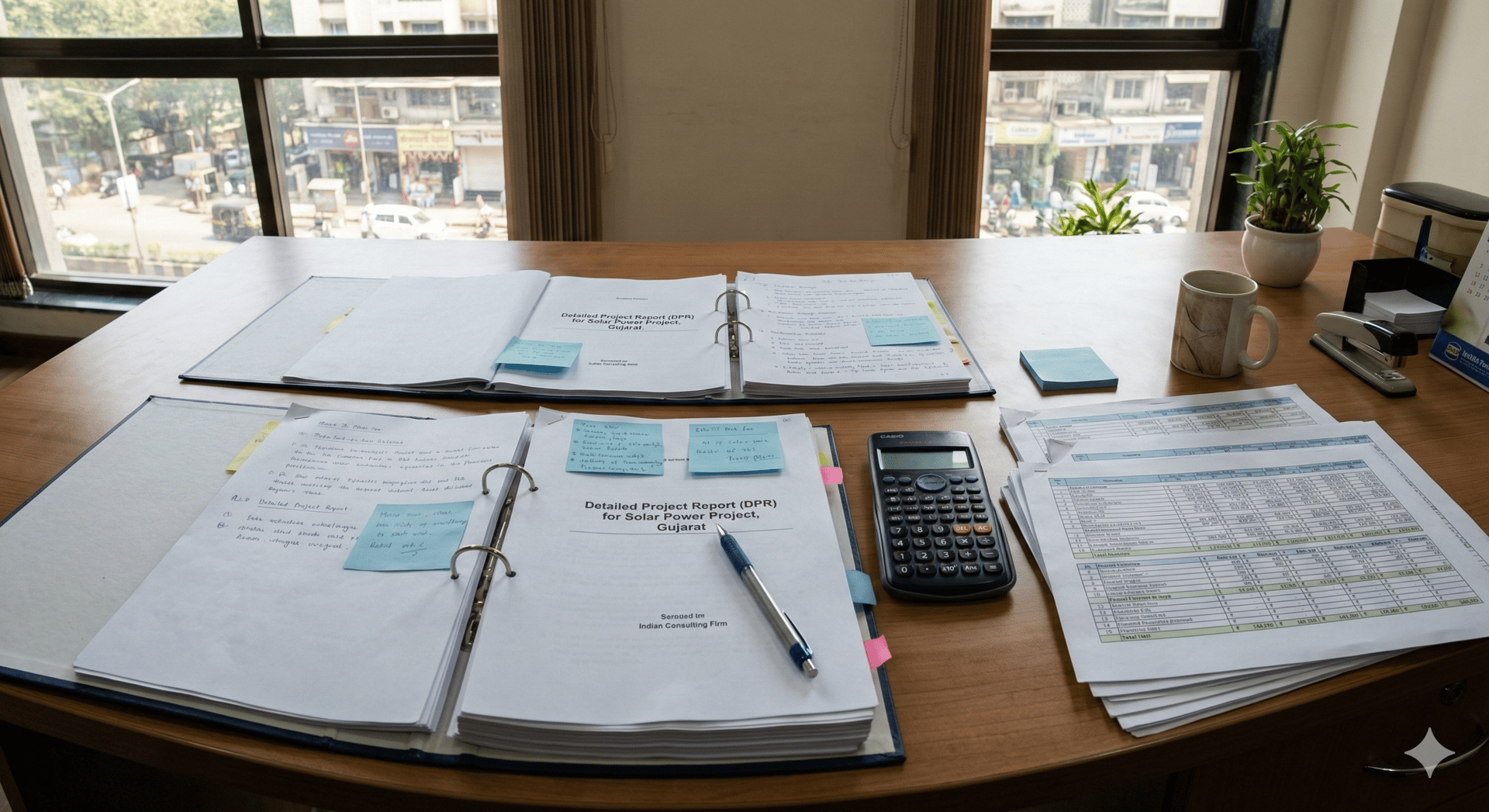

Prepare a custom Project Report based on your business and loan proposal

Align write-up with bank appraisal flow

Clearly present project cost, funding pattern, and viability

Coordinate DPR structure with CMA and financial projections

Reduce unnecessary back-and-forth with banks

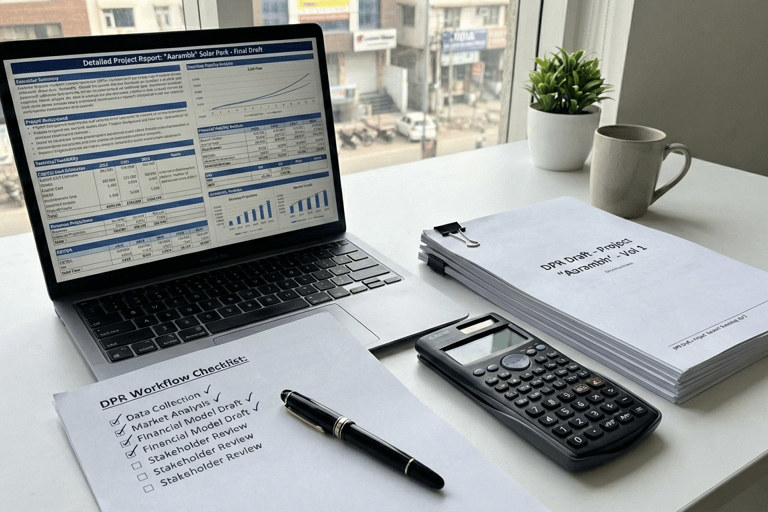

You share basic business & loan details

We understand bank requirement & loan purpose

Project Reports are prepared in structured, bank-ready format

Revisions done (limited & defined upfront)

Final Project Report & CMA delivered for submission

What goes into preparing a Project Report

Suitable for

Business loan applicants

Trading, service, or contract businesses

New or expansion projects

Single-bank proposals

WHO THIS IS FOR / NOT FOR

Not suitable for

Consortium lending

Court / litigation projects

Highly specialized technical reports

Project Report works best when aligned with CMA

In most bank loan cases, Project Report and CMA are reviewed together. Preparing both in isolation often leads to inconsistencies and queries. We also provide Project Report + CMA preparation as a combined service for smoother and faster loan processing.

Starts at only ₹2,999

Need a DPR prepared professionally?

If you prefer your Project Report to be prepared professionally and aligned with bank expectations, request Project Report preparation below.

Starts at only ₹2,999

FAQs

What are these tools?

They generate DPR and CMA reports needed for bank loan approvals.

Why do banks require them?

Banks use these reports to assess your business’s financial health and repayment ability.

How do these tools save time?

They automate report creation, reducing manual errors and speeding up the loan application process.

Who should use these tools?

Small and medium business owners, manufacturers, traders, and service providers.

How do I get started?

Click “Get Started” to begin preparing your reports quickly and accurately.

Contact Us

Reach out for support or questions about our tools.