CMA Excel System for Bank Loans

A structured Excel system to prepare bank-ready CMA data,ratios, and 5-year projections for loan appraisal.

Why CMA preparation feels confusing

Banks rely heavily on CMA data to assess risk, repayment capacity,and financial discipline.

Most business owners don’t understand the format, and end up payinghigh CA fees even for straightforward cases.

A structured CMA system, not just an Excel format

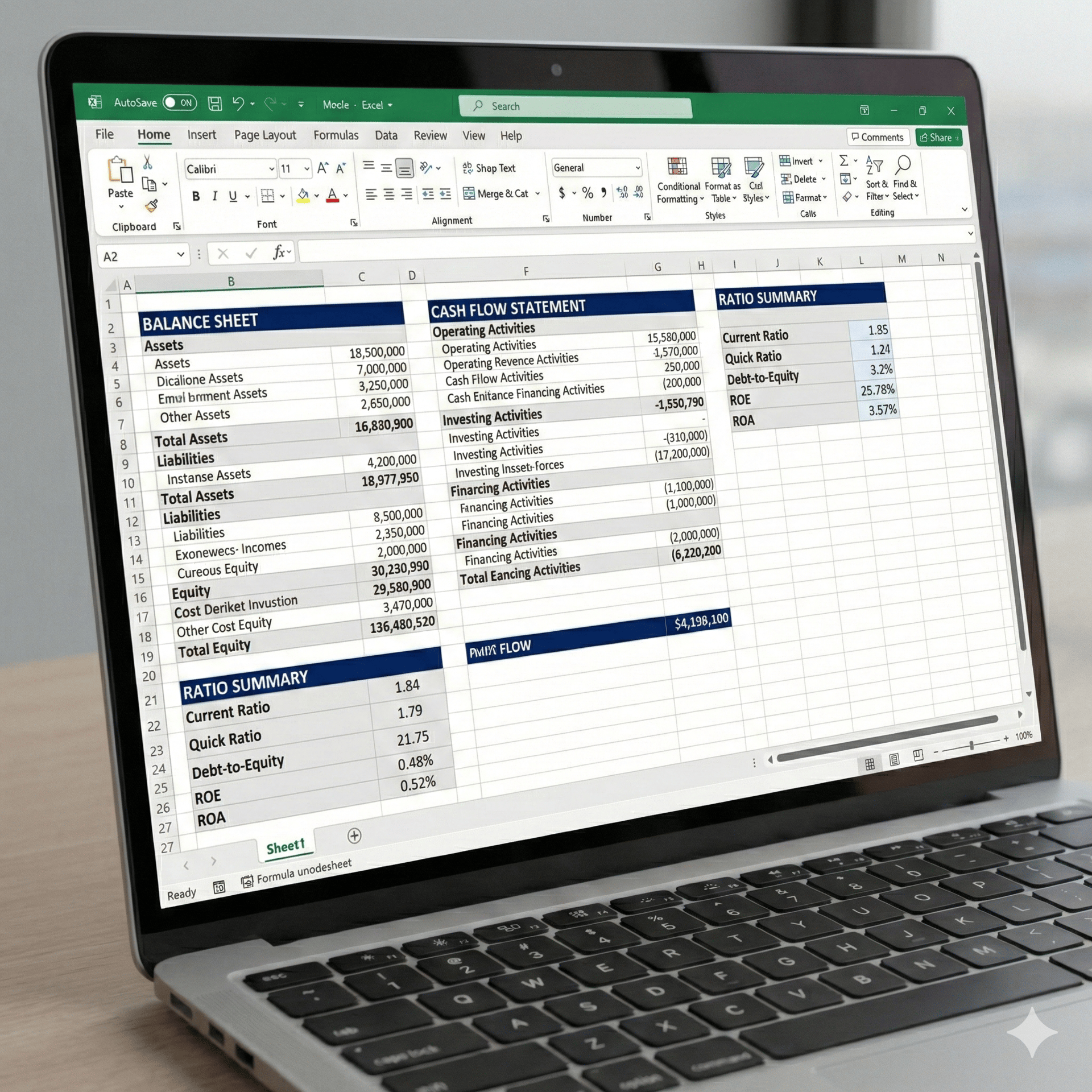

This is a professional CMA Excel system designed to convert your business numbers into bank-ready financial statements and ratios.

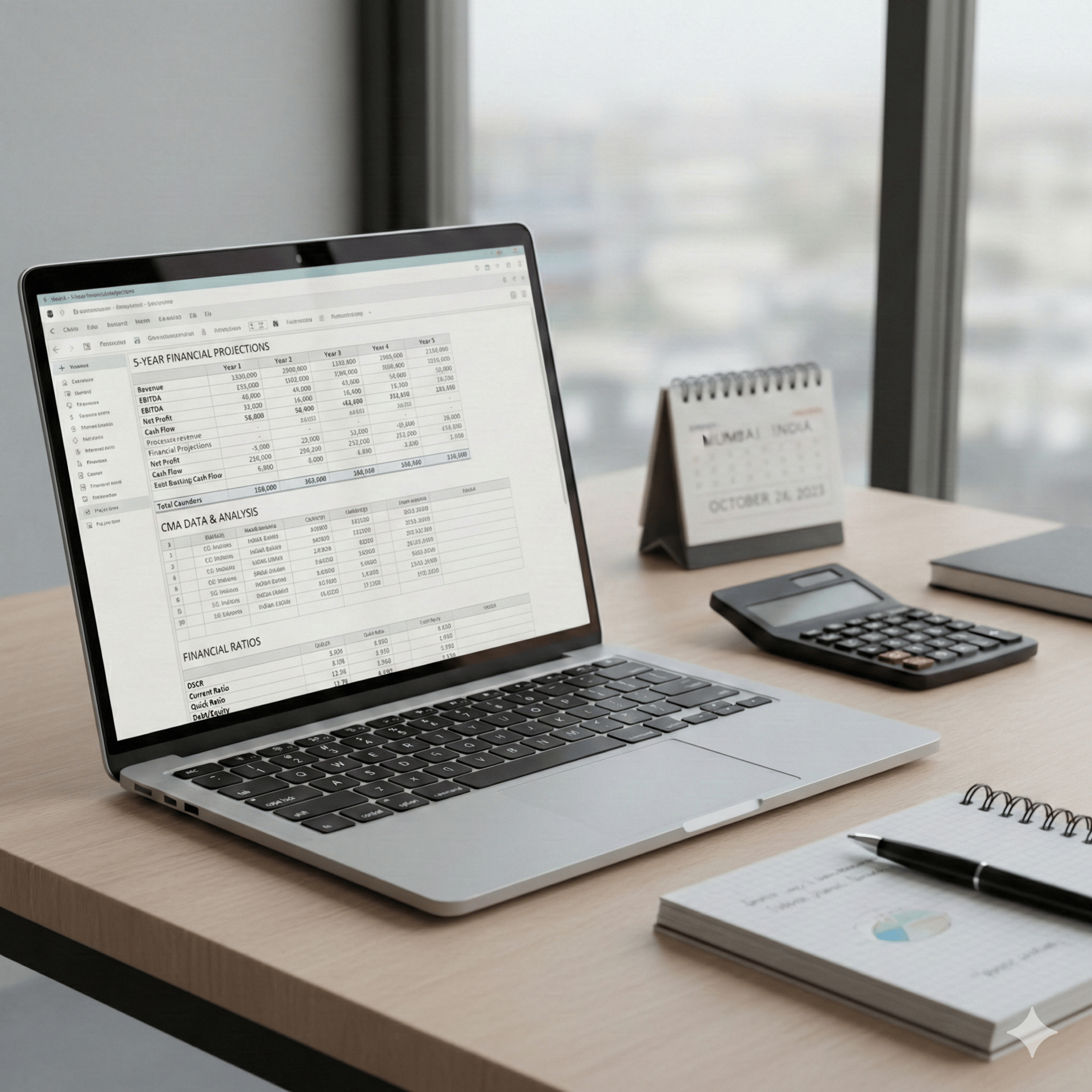

5-year financial projections

Automated P&L, Balance Sheet, Cash Flow

Banker-focused ratios (DSCR, CR, ICR, TOL/TNW)

Built-in checks to highlight risk areas

Print-ready CMA output

KEY FEATURES

The system follows a structure commonly reviewed by banks during credit appraisal, helping reduce unnecessary queries.

Designed the way banks review CMA

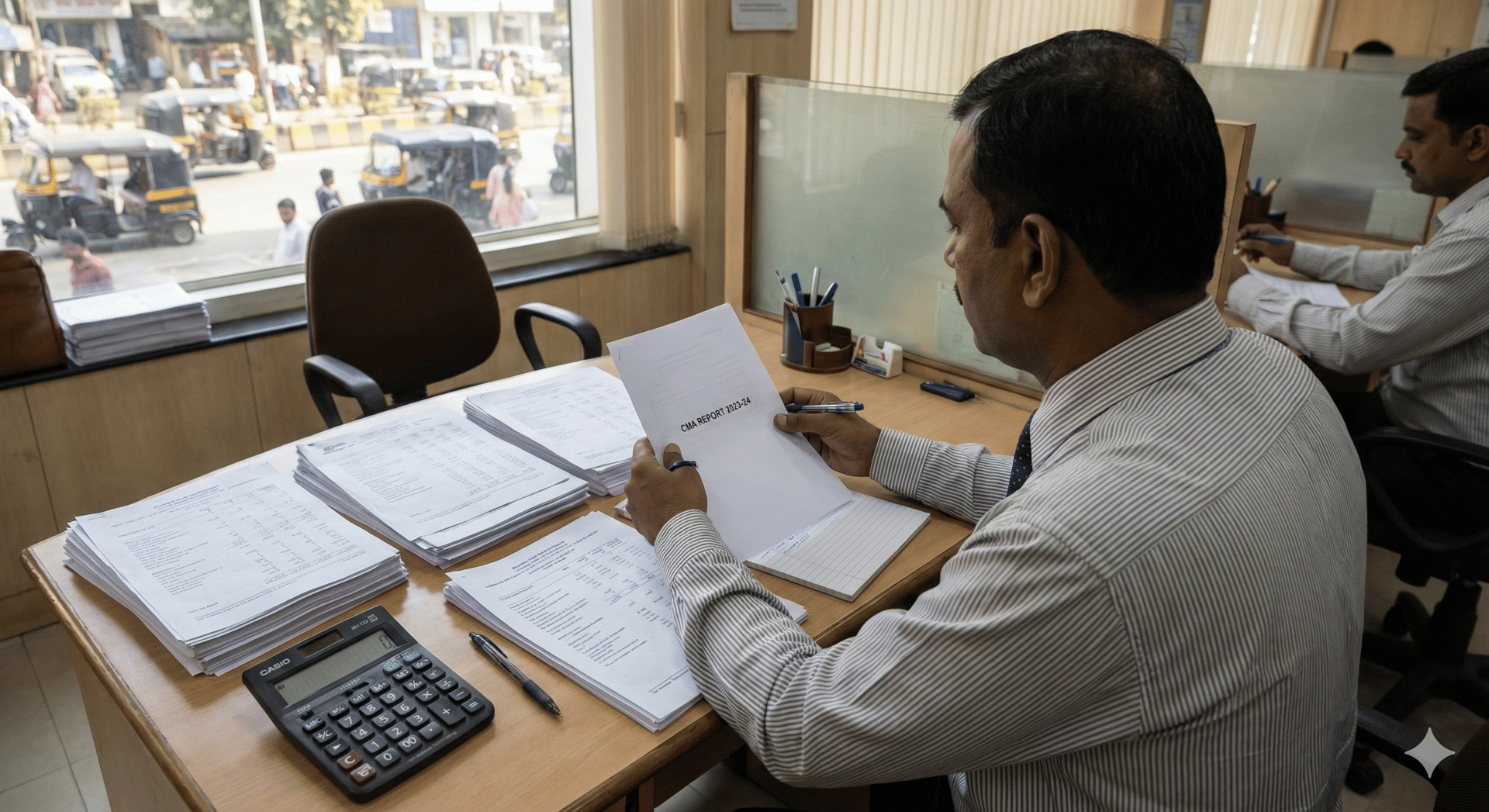

Prefer professional handling?

Many business owners choose to get CMA prepared professionally to avoid errors, delays, and repeated bank questions.

You can either use the system yourself or opt for professional CMA preparation after checkout.

FAQs

What are these tools?

They generate DPR and CMA reports needed for bank loan approvals.

Why do banks require them?

Banks use these reports to assess your business’s financial health and repayment ability.

How do these tools save time?

They automate report creation, reducing manual errors and speeding up the loan application process.

Who should use these tools?

Small and medium business owners, manufacturers, traders, and service providers.

How do I get started?

Click “Get Started” to begin preparing your reports quickly and accurately.

Contact Us

Reach out for support or questions about our tools.